Chase Professional Risks: Focus on Construction

Construction Professional Indemnity

We take this opportunity to outline our risk appetite in this sector, as well as some of the features of our Construction Professional Indemnity policies.

In the lead up to the busy June period, we thought it would be opportune to remind brokers of Chase's broader capabilities in financial lines. While many would be conversant with Chase Professional Risk's broad PI appetite for professionals across many disciplines, what may not be as well-known, is Chase’s capabilities in underwriting professionals and projects in the Construction sector.

Our risk appetite

1. Annual policies

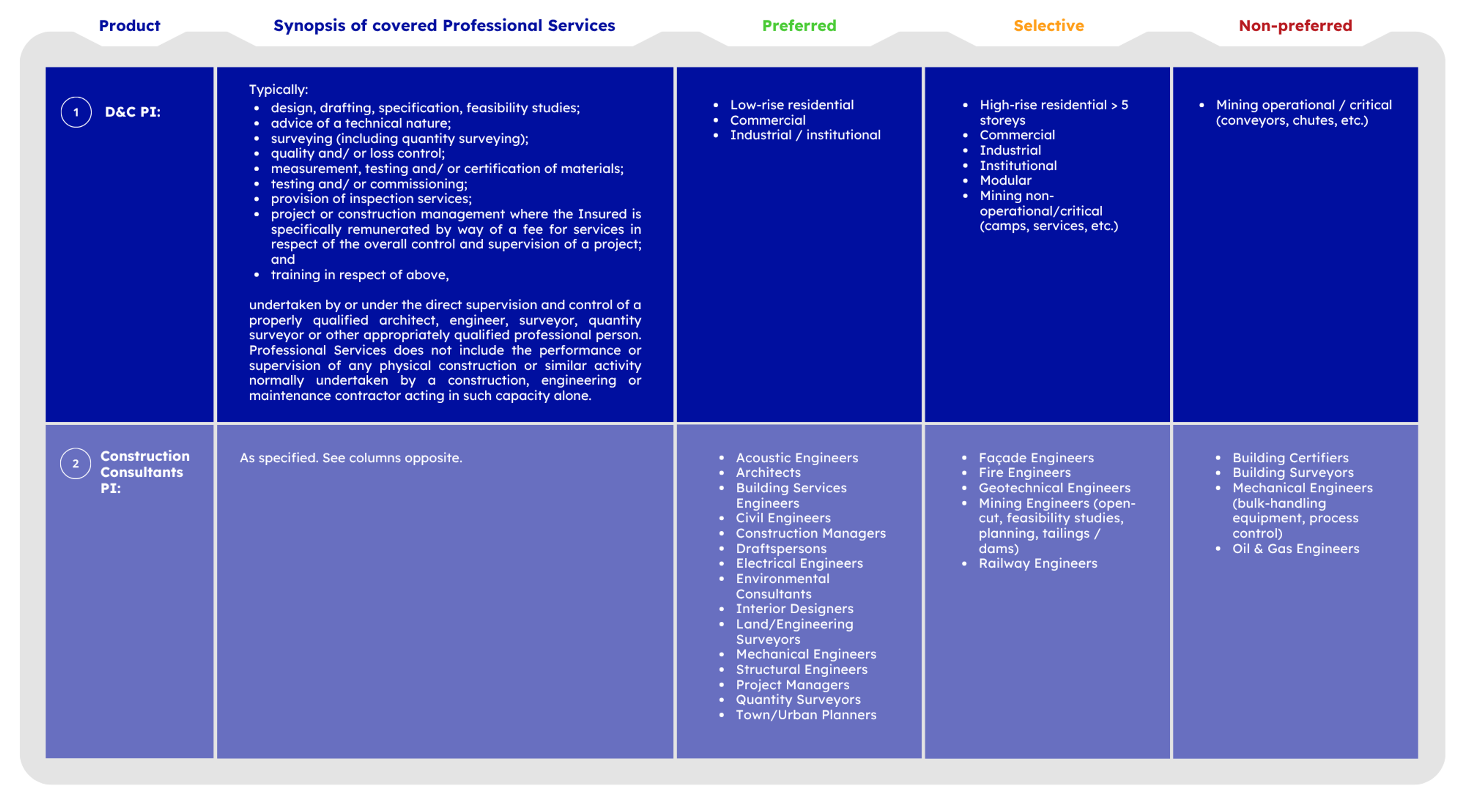

The diagram below provides a high-level summary of our appetite in each of the following construction areas.

Design & Construct (D&C) PI: Refers to professionals who provide designs or advice such as architects, building surveyors, structural or civil engineers, interior designers, project managers and who are also responsible or involved in the physical construction.

Construction Consultants PI: Refers to professionals who provide expert advice, design, and support to clients in the construction industry and who are not involved in or responsible for the actual physical construction (see D&C).

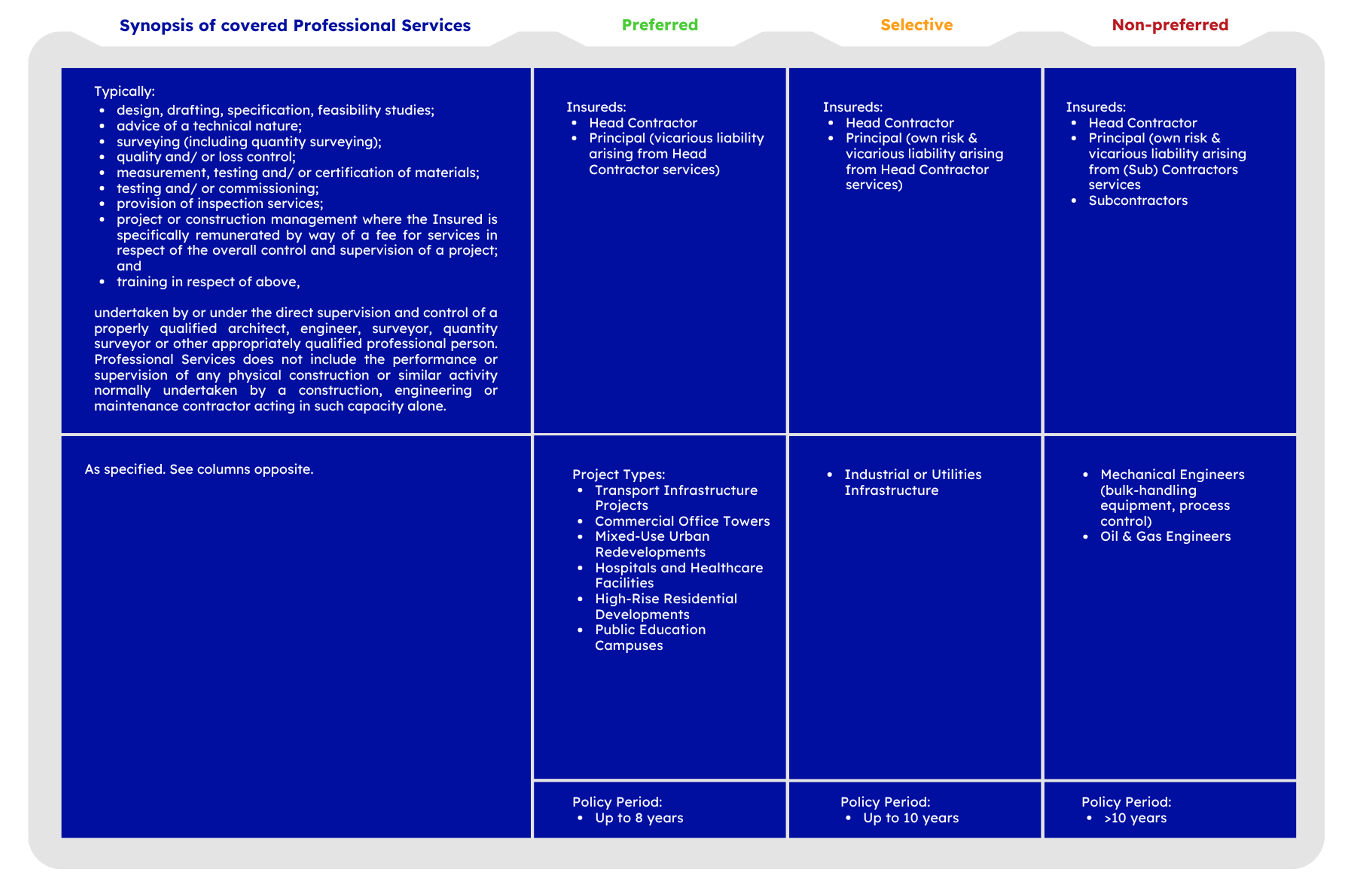

Single Project policies

Refers to long term single project PI placements (typically up to a maximum of 10 years) covering multiple insureds who are engaged in the delivery of a construction project. A Single Project policy offers the parties the peace of mind that their interests are covered for the duration of the project (and beyond), and is not conditional on claim performance or an annual renewal process once the policy is placed.

Features of Chase's PI policies

Chase's PI policies offer market leading terms and conditions, including the following features. Please always refer to the policy wording to properly evaluate the scope of cover or speak to one of our underwriters to understand how our cover would respond.

Insuring Clauses and Extensions

- Civil liability coverage

- Advance payment of Defence Costs

- Continuous cover

- Consumer legislation protection

- Non-Imputation/Breach of Conditions

- Vicarious liability

- Loss of Documents

- Inquiry Costs

- Collateral Warranty cover

Optional Extensions

- Contractual liability

- Limitation of Liability

- Loss Mitigation and Rectification

- Novated Designs

- Proportionate Liability

Exclusions

Policy exclusions are narrow by market standards and carefully structured. As an example, there is no exclusion relating to pollution liability.

Important Conditions / Claim Conditions

- Non-imputation clause

- Run-off Cover

- Rectification Costs

- Retroactive Cover

Capacity

- Professional Indemnity: Policy limits up to $20 million any one claim and in the aggregate are available under our automatic binding authorities. Higher policy limits are available on request.

- General Liability (GL): Office-based GL cover up to $20 million any one occurrence is available under facilities. Broader construction and other GL policies are available working closely with Chase Construction.

Cover

- Is typically provided on the basis of an Annually Renewable policy, with bespoke coverage provided for Single Project PI.

Contact us

Please contact one of our Professional Risks Underwriters if you have any queries or wish to obtain a quotation.